You know, the Buffet tax. It's the tax proposed in Washington to assure millionaires pay a "fair share" according to the Washington politicians. Looking at the list of country stars and their incomes, here's a representative list of who would be paying.

Toby Keith tops Forbes' "Country Music's Highest-Paid Stars" list with $50 million.

Earnings from tour dates (more than $500k at each stop), I Love This Bar & Grill estimates ($8m in 2010), the Wild Shot Mezcal launch and a Ford sponsorship.

Here are the remaining top 10:

#2 - Taylor Swift ($45million) – Her concerts bring in $750,000 per night in gross ticket sales (Add Merchandise – WOW!).

#3 - Brad Paisley ($40 million) - Nearly doubling last year's earnings thanks to sponsorship deals with Chevy, Sea Ray and others. Sea Gayle Music, the music publishing company Paisley co-founded in 1999 is another revenue generator.

#4 - Tim McGraw ($35 million) - In addition to grossing $575,000 per night on tour, McGraw took in an estimated $3.3 million from films Country Strong and Dirty Girl. His line of cologne is among the best selling celebrity scents.

#5 - Rascal Flatts ($34 million) - rely on touring, merchandise and royalties for the bulk of their earnings.

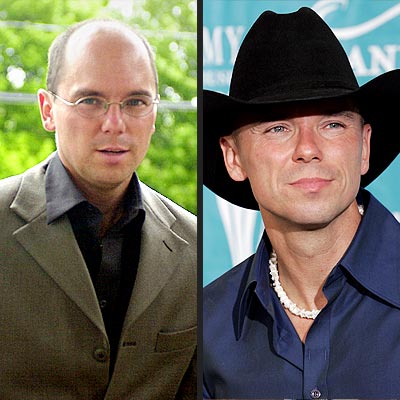

#6 - Kenny Chesney ($30 million) - Chesney's concerts gross an average of $1.6 million every night. Chesney also raked in an estimated $7.5 million in royalties in 2010.

#7 – George Strait ($24 million) - The oldest singer on the highest-paid list – Touring is the bulk of his earnings in just over thirty shows, spread out over 12 months; each of Strait's concerts pulls in a whopping $1.4 million.

#8 – Alan Jackson ($22 million) – Making most of his money on touring.

#9 – Carrie Underwood ($20 million) - Branching out in lucrative fashion and she signed a deal to be the first North American spokesmodel for Olay.

#10 – Sugarland ($18 million) – Making most of their money on touring and royalties.

The list reflects earnings between May 2010 and May 2011.

Forbes consulted agents, managers, publishers, lawyers and others to compute the estimates, which are gross earnings. Taxes and other components (agent and manager fees) are not deducted.